It is time to be bold.

The world teems with opportunities for us once we leave the EU on 29 March next year.

We must show how we will use our new financial freedom from paying so much to the EU.

We must become again the low tax party. We believe individuals and families are best spending their own money on their own priorities. We need to cut the rates of Income tax so people keep more of what they earn.

We must be the party that backs enterprise and lets people enjoy the rewards of success. That means cutting the rate of Capital Gains tax.

We must be the party that helps people own their own home. Lets begin by getting Stamp duties down from the high levels George Osborne wrongly imposed.

We should want to have a strong car industry, and allow people to buy good modern cars made in the Uk . That means taking Vehicle excise duty back down to more realistic levels.

Its not just a case of cutting corporation tax for the bigger companies , but cutting taxes on small businesses and individuals who take risks, create jobs and drive innovation.

Whilst we are about it lets cut business rates as well.

Some of these measures will raise more revenue, as the Treasury has imposed high rates which bring in less revenue. Others have a cost to be paid out of the savings in the EU budget.

We need to make the case again for freedom and free enterprise. This week we heard the marxist alternative. They tried that recently in Venezuela.The nationalised oil industry which was meant pay for it all now struggles to produce half the output it used to produce when in the private sector. They ended up gravely damaging the golden goose, a country with more oil reserves than any other now has empty supermarket shelves and an economy in collapse. Marxism has driven them into needless poverty.

So lets explain that price controls, nationalisations, government interventions may look well meaning but end in tears. Those policies hit the poor instead of helping them, and drive the rich out of your country. If government does not support and promote free enterprise it makes the country poorer. You can tax an economy into poverty. You can spend and borrow too much in the public sector leadig to a rapid inflation and a fall in your currency, which also hits the poor you are trying to help. You do not make the poor rich by making the rich poor.

Author: johnredwood

Government tax attack on cars works

The latest figures show a further decline in the UK output of cars for domestic sale, as the government wished. They imposed higher taxes and threatened more taxes and bans. How much bigger fall do they want?

Amphibians do jump out of water that gets too hot

There were many years ago apparently scientific experiments to test the idea that if you left an amphibian in water which you heated up gradually it would not notice, dying when it got too hot. I always thought that a strange idea based on most cruel experiments. Most people think it is untrue. An animal will jump out when it senses the water is getting too hot. I am glad they do, for their sakes.

Some in the political world use the story of the boiling water as an analogy based appropriately on a falsehood to describe the way some people apparently will stick around supporting policies and proposals they dislike intensely if they are introduced slowly and stealthily. There has been a rumour about the Remain forces in the government using this technique to get more Leavers to accept more and more of the EU they are seeking to leave, by gradually introducing these features back into the promised Brexit the government is arranging. Thus we saw a progress of more EU controls, payments and laws being introduced from the original Lancaster House statement to the Florence speech, and from Florence to the Mansion House text, to end up with the Chequers proposals.

Gradually the crucial features of Brexit were eroded or removed. Instead of getting all our money back from Day 1 we were told there would be a big and lingering bill. Instead of getting freedom to set our own benefits and work permit policies, we were told we needed to accept some freedom of movement and some payment of benefits to EU citizens on arrival. Instead of getting full freedom to negotiate our own trade deals, we were told we had to live with accepting many EU rules and regulations which might get in the way of trade agreements. Instead of leaving on 29 March 2019 we were told it would be delayed for another 21 months for no good reason. Instead of getting control of our fish from next year, the timetable slipped and the language implied we would continue to give away much of our fish stock.

As any sensible person would predict, the latest version of Chequers represents unacceptably hot water, so the Brexiteers have indeed jumped out. The government has kindly proved again the commonsense view that you cannot get people to change their minds on fundamental issues by seeking to change them gradually and by stealth. They do notice, just as any animal spots the water getting too hot.

The EU’S borders

The main issue tackled at Salzburg is of great interest and concern. How many migrants should the EU admit? What controls should it place at its external border to control numbers arriving? How many of those borders should be hard physical borders with walls and fences, watch towers and plenty of staff? The EU has helped fund just such a tough border for Turkey with the states to the south, and some states like Austria and Hungary have also built their own walls and fences with razor wire.

The EU has a European Border and Coastguard service or Frontex, with a headquarters in Warsaw. The informal Council discussed whether this should be substantially beefed up with 10,000 new recruits to help member states handle the big issues of entry into the EU. To date Frontex has always claimed member states have the responsibility for policing their own borders, to an approved set of common rules. Frontex has access to specialist personnel and equipment to come and assist where there are particular problems or pressures. Recruiting many more staff would be a precondition for Frontex becoming a much more active participant in border security. Frontex offers ships, trained personnel and surveillance equipment.

Member states are divided on this issue. There is a strong wish to see tougher common EU border security, but also in some cases a reluctance to surrender power to police the border to an EU authority. Some states like Hungary and Austria have pushed their interpretation of EU policy a long way in the direction of hard borders and tough controls. The EU is now responding. It has a good relationship with Egypt to deter migrants from that country. It is now collaborating with the Libyan coastguard so more people rescued at sea who started out from Libya are returned to Libya. It is looking to enter agreements with more North African states, just as it has done with Turkey. In return for substantial sums of money, Turkey has agreed to provide a home for Syrian refugees and not to send them on to the EU.

Mr Salvini in Italy is pressing hard for a much tougher EU stance on migration. He has been refusing boats the right to land, and has recently organised the removal of a Panamanian flag from a charity boat that brings migrants from the sea to the shores of Italy, to remove the boat’s right of passage. The EU do not like his approach, but so far have been unable to stop it.

Letter from the Secretary of State for Education

I have received the enclosed letter from the Secretary of State for Education:

With the new academic year now underway throughout the country, I wanted to let you know about some new international comparisons of education funding, and to update you on some other education matters, which may be of interest to schools in your constituency.

International comparisons

This week saw the publication of the 2018 edition of the OECD’s ‘Education at a Glance’, the definitive comparative guide to education systems in the developed world. It shows:

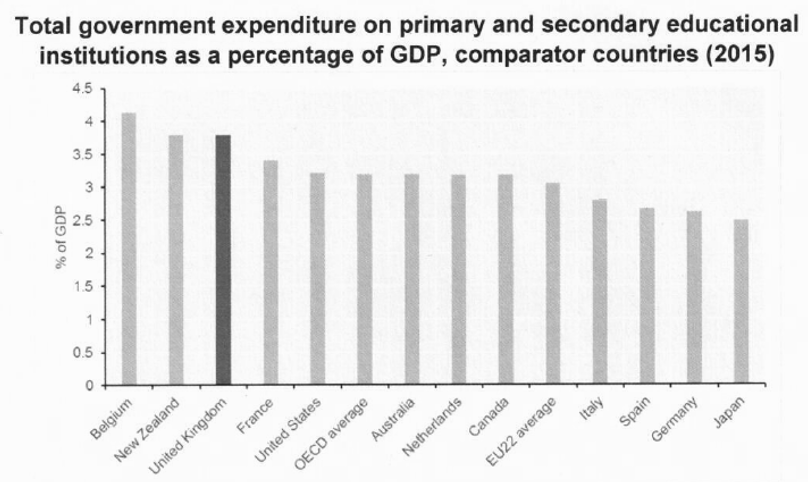

• The UK spends more on state-funded primary and secondary education, per pupil, than France, Germany, Italy, Spain, Australia and Canada.

• The UK spends more on state-funded primary and secondary education as a proportion of GDP than all those countries above, plus the US.

• Pre-school education at ages 3 and 4 is now near universal in the UK.

• The UK’s universities remain the world’s second most popular choice for international students, after only the US.

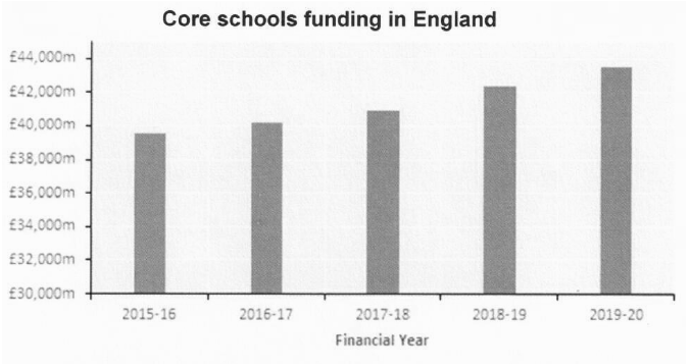

There is more money going into our schools than ever before; as the graph below shows, budgets have risen every year since 2015. This year the core school budget increased to £42.4 billion and will rise further to £43.5 billion in 2019-20. This increase follows the additional £1.3 billion, over and above what was promised at the last Spending Review, added to school budgets by prioritising front-line spending within the Department for Education’s budget.

Funding for the average primary school class of 27 pupils this year is £132,000, £8,000 more in real terms than in 2008. The same 27 children will be funded on average £171,000 when they move in secondary school, a real terms rise of £10,000 compared to a decade ago. Figures from the independent Institute for Fiscal Studies (IFS) show that real terms per-pupil funding in 2020 will be more than 50% higher than it was in 2000. Overall, the latest published figures for England’s schools show a cumulative surplus of more than £4 billion, against a cumulative deficit of less than £300m. The proportion of schools in deficit, or in a trust with a deficit, was lower in 2017 than in 2010.

In addition, we are investing £6 billion in the High Needs budget, which covers support to children with complex special education needs and alternative provision across England. This is now at a record high, 20% more than in 2013-14.

The national funding formula

Alongside this extra funding, we have also taken on the historic challenge of introducing a fair national funding formula, to ensure school funding is distributed to where it is needed most. Since April this year, funding has been directed based on schools’ and pupils’ needs and characteristics – not accidents of geography or history.

Schools are already benefitting from the gains delivered by the national funding formula. Next year, schools that have been historically underfunded will attract up to 6% more, per pupil, compared to 2017-18 – a further 3%, per pupil, on top of the 3% they gained in 2018-19 – as we continue to address historic injustices.

The very minimum additional amount that any school attracts in 2018-19 as a result of the national funding formula is 0.5% per pupil, compared to 2017-18 baselines – though the final amount received by schools can be affected by decisions made at a local level, for example if the local authority decides to transfer some funding to its High Needs provision.

Teachers’ pay and pensions

There can be no great schools without great teachers. That is why we have committed to making sure that teaching remains an attractive and fulfilling profession. Our classroom teachers in their twenties earn around £2,000 per year more than the average graduate in their twenties and the average salary for all teachers is £38,7000 (£35,400 for classroom teachers, £58,100 for those in leadership positions).

Just before summer break, we announced the biggest increase to teachers’ pay since 2010. This includes a 3.5% increase to the main pay range, building on last year’s 2% uplift, which will raise starting salaries significantly and increase the competitiveness of early career pay. We have also announced uplifts of 2% to the upper pay range (for more experienced teachers) and 1.5% for school leaders.

These increases will be fully funded, with a teachers’ pay grant totalling £508 million over 2 years, over and above the funding that schools receive through the national funding formula. This will cover, the difference between this award and the cost of a 1% award that schools would have been planning for. We are announcing further details of this grant today, with allocations made to schools later in the autumn term.

HM Treasury has also recently published changes to the Teachers’ Pension Scheme (along with other public sector pensions). We intend to fully fund schools for the additional pressure that the increase in pensions contributions will place on their budgets. The core schools budget will continue to be protected in real terms per pupil. The precise impact of the pensions changes is now being calculated, and we will consult on the distribution of this funding, and announce it in good time before schools have to start paying the new contributions in September 2019. The Teachers’ Pension Scheme remains one of the best pension plans in the country.

Misleading claims from 3rd parties

You may have seen figures based on the flawed calculations of the “School Cuts” campaign. This campaign misrepresents the funding schools will receive, presenting historical pressures on school budgets as if they were still to occur.

We have continued to challenge the misleading claims made on their website and in the media. As a result, the campaign has rowed back on some of these and made changes to their website. For example, the campaign claimed that per-pupil funding has reduced in real terms in 2018-19, but had to admit that they simply got their numbers wrong. They have since accepted what the IFS has confirmed – that the schools budget will be maintained in real terms per pupil over 2018-19 and 2019-20.

Support to schools

Of course, even with this protection of the overall schools budget, cost pressures in recent years have meant, in individual cases, budgets can feel tight.

We have just launched a Supporting School Resource Management document which provides schools with practical advice on savings that can be made on the £10 billion non-staffing spend spent across England last year. This summarises the support the department is making available to help schools reduce cost pressures and make every pound count to produce the best outcomes for pupils.

One of the tools available is our financial benchmarking service. This helps schools to compare their spending on a wide range of costs with that of similar schools, to share good practice and to identify where they can make savings so that they can direct the maximum resource into good quality teaching. Using this service, schools in your constituency can compare themselves on individual cost categories, to see where savings may be possible, to re-invest in frontline education.

Among the new initiatives, we are bringing forward our Supply Agency Framework and purchasing programmes across spend areas as diverse as facilities management, stationary, energy and software licences. Thousands of schools are already saving significant sums on insurance through our Risk Protection Arrangement programme. The new, free Teacher Vacancy Service will help bear down on recruitment costs. It is currently being piloted in Cambridgeshire and the North East.

We are providing direct support to schools and trusts with particular financial challenges and are increasing the number of School Resource Management Advisers to be deployed in 2018/19. We are also encouraging schools to integrate their curriculum and financial planning to inform decision-making on the deployment of teaching staff.

Quality expansions

Between 2004 and 2010, there was a net loss of 100,000 school places. By contrast, since 2010 we have brought about an ambitious expansion in our school estate to ensure we cope with population growth, and that parents have high-quality choices (this year 97.7% of families got one of their top 3 choices for primary and 93.8% did for secondary).

We have opened 53 new free schools this month, along with one University Technical College. We are enabling selective schools to expand if they come forward with a compelling plan for how they will widen access. And we have created a route for new Voluntary Aided schools to open. All told, we will have created a million more school places this decade – the biggest expansion of school capacity for at least two generations.

Rising standards and narrowing the gap

All this work is paying off. There are now 1.9 million more children being taught in good or outstanding schools. This means 86% of children attend good or outstanding schools – up from 66% in 2010. Our primary children have risen from 19th in 2006 to joint 8th in 2016 in the world reading comparisons. And young people are now being better prepared for work and further study through reformed GCSE and A Level courses.

The attainment gap between disadvantaged pupils and their better off peers has also fallen at every stage of education: 11% for early years (since 2013), 10% at both key stage 2 and GCSE (since 2011), and we are seeing record numbers of university admissions for young people from disadvantaged backgrounds. This is in addition to a record low in the number of 19 year olds not reaching the equivalent of Level 4 or above in England and Maths.

Yours ever

Damian Hinds

Secretary of State for Education

Let’s go for higher wages, not more cheap labour

Many people are tired of the model of business which keeps inviting in people from the continent to take low paid jobs. No wonder we have a productivity problem, as recruiting tens of thousands each year to low productivity low paid jobs has become common.

I want business to employ more people who are already settled here. I want them to offer better wages to encourage more people into work. Because wages have to be earned that means offering training and investment support to each new worker so their productivity justifies the better pay. More computing power is needed to raise productivity in clerical and administrative functions. More machine power is needed in warehouses, on building sites and in older factories, to make the task easier for employees.

It is better to employ fewer people on better pay, and to seek to motivate and mentor them so they earn their wages and get more out of their jobs. There are many good firms in the UK who do a lot to nurture talent, to give people a second chance if they did not do well at school and need some educational support as adults. There are companies that like to promote from within, to give people a clear sense of career progression and opportunity within the firm. Good bosses welcome talent, foster better standards and higher achievement, and understand the training and motivational needs of their employees.

Getting the right structure of rewards and incentives is not easy. If there is no financial recognition of superior effort and achievement it is difficult to drive a business to higher levels of quality and efficiency. If there is too much emphasis on one or two variables that determine a bonus, it can distort the efforts of staff or even lead to unwelcome practices as we have seen in some companies where bonus calculations lead to conduct which is not in the customer interest. Successful bonus and pay rise schemes align the interests of the employee with the interests of the customer, and therefore also work for the shareholder.

In every business all staff need to know they are important and what they do is important. They need to know there is plenty of opportunity to learn and to gain higher pay and more responsibility if they are good. They also need to know above all else that everything they do has to be for the benefit of the customers, who pay their wages as well as the shareholder dividends.

The contradiction of the Remain business case about Brexit

We often have the parade of those few Remain advocates claiming to speak for big businesses that want to stop Brexit. They frequently repeat themselves, going public to help the Remain cause. They argue more than one foolish contradiction.

The most obvious is their statement that leaving the EU without a very costly Withdrawal Agreement is plunging off a cliff, conjuring false images of sharp falls in output. They then follow this with their number one complaint that once out of the EU we will lose access to cheap labour from the continent which they say is needed to deal with the increased demand and expansion of business which they will be grappling with.

If they truly believed output will fall and stay lower as they imply, they would not bother to seek more labour. They would be planning an orderly reduction in the size of their workforce as people retired or left for other reasons. Their economic forecasts have been so bad for many years. The pro EU lobbyists wrongly wanted the Exchange Rate Mechanism, which did lead to a sharp fall in activity and business output and led many businesses to sack people without warning because they had failed to foresee the results of their ill judged lobbying for the ERM. They wrongly went along with or encouraged the Euro, which did considerable damage to UK export markets on the continent after the banking crash, when that was extended and worsened in the Euro area by the Euro crisis.

Next they wrongly forecast a fall in UK output in the months immediately after we voted to leave, which did not happen . Nor is there any no good reason to think that actually leaving should lead to that. Of course the UK needs to follow good positive domestic policies to thrive outside the EU, just as we needed to do that to grow or to offset harmful EU policies when in it. If we just get on with spending domestically all the money we save on leaving, the economy will perform well.

Let me reassure them again. UK output will not be damaged by leaving. It could expand more than currently if the government stopped its ever tightening monetary and fiscal squeeze. The correct thing to do would be to offer tax cuts and increased spending in this autumn’s budget, covered by ending payments to the EU.

Business needs to turn its mind to productivity, and wean itself off the ever more cheap labour model. Together we need to build a world of higher pay, high skills and more computing and machine power to help people be more productive.

How did England win Trafalgar?

Most know that England defeated France at Trafalgar, though suffering the loss of Admiral Nelson. But did you know the French and Spanish allied fleet in that action had 45% more firepower than Nelson’s force, with the ability to shoot 28.3 tonnes of cannon balls on a single firing if they fired all the guns? Several of the English ships were crippled without masts or rudders but fought on as massive floating batteries drifting in the sea. In the light winds Nelson’s force was exposed to broadsides for around 30 minutes before they were in a position to fire back. So how did they manage to win?

Find out at the Swallowfield event on Saturday October 20th when I will be showing pictures of the action and telling the story of this amazing and decisive battle.

Tickets from Bob Hamer at dbobhamer@btinternet.com Tel 01189 733422

Why I want to leave the so called single market

I accepted the verdict of UK voters as a young man in 1975 when I was on the losing side of the referendum on staying in the EEC. I decided I had to make the best of it. When I entered Parliament I tried to limit the EEC/EU to what people voted for, a common market. My worry had always been it was a much mightier political project, but Remain always told us in the early years it was not a currency and political union in the making. Later of course it became obvious that it was a currency union, with a political union in the offing.

So what changed my mind about the common market part of it? It was being given the role of Single Market Minister in the 1990s, when the EU wished to “complete” the single market. That turned out to be a double lie. The EU did indeed have a massive legislative programme which it called the single market programme in those days, and did more or less complete the stated programme by 1992. It then went on to invent many more legislative programmes in the name of its new creation for many years afterwards, proving the single market was in its view no where near completed in 1992 despite the claims. It was also misleading, because as I discovered it was not primarily a programme to open and liberate a wider market. It was a huge power grab. It thrived on the doctrine of “the occupied field”, pressing EU legislation into many new areas in the name of the single market to take powers away from national democracies and to place them in the hands of unelected Commissioners and European Court judges.

As I used to point out to the bureaucratic, legal and regulatory minds assembled, you only need one simple rule to have a common market. That rule, established in a famous European Court case, states that if a product is of merchandisable quality and has passed the tests to be offered for sale in one part of the common market, it should also be allowed for sale anywhere else in that market. It does not mean British people have to suddenly develop a passion for German sausage or French people need to learn to love English cheese. It does mean that as Germany tells us their sausage is fine for consumption their sausage makers should be allowed to offer it to British consumers to see if they want to buy it. It means each part of a common market has to trust each other part for their standards of safety, hygiene and the rest, or allow only limited specified national overrides for public health and safety but not much else to restrict the flow of goods.

Instead the EU embarked on a comprehensive legislative programme to superimpose EU law on top of member state law to govern everything from food standards to control of hazardous chemicals, and everything from labour rules to environmental protections, all in the name of the single market. The laws often told businesses how they were to make or design something. It was very clearly a programme to create a supranational government. It soon replicated all the main departments of national governments, with a foreign policy, a security and defence policy, an environment , transport and employment policy and much else.

The market part of it proceeded by the Commission working with the dominant companies of the day in each sector to draw up a set of rules which would be required of everyone. These rules were welcomed by the big business that helped inform them, because they already met them. They were opposed by some big businesses which had not been so successful in lobbying and drafting. They often acted as restraints on c0mpetition and innovation, as they prescribed the way firms were allowed to make and sell things. These rules were imposed in the name of cross border trading, but were also mandatory for the much larger flows of goods and commerce within each individual member state where they were not needed to assist international trade and might override perfectly good familiar national systems. Many smaller businesses found the extra cost of EU regulation, and greater prescription, made market entry and offering competitive product more difficult.

In the first ten years of our membership of the EEC our motor car output halved, unable to face the onslaught of German and French competition without tariffs and under EEC rules. Meanwhile in the areas where we were strong in services no similar market opening occurred, leaving us a growing and large balance of payments deficit which has persisted to this day. I came to the conclusion that the single market was not designed to help the UK, and we would be better off making our own rules and running our own global trade policy.

Visit to Costco, Reading

I visited Costco at Green Park Reading following their invitation. They wanted to show me their facilities and talk about their employees and their relationship with the local community.

They assured me they paid above the market average, liking to recruit and retain good people. Their retention rate is good. They have training programmes, and assist employees who wish to progress through internal promotions. I am a strong supporter of employers paying decent wages, understanding the ambitions of their staff and giving them help to move upwards in the organisation.

They told me of the work they do to raise money for charity, and the way they have some charities as members to take advantage of their prices and service for the wholesale trade. The main issue they raised for government was the question of taking more action to defeat smuggling of alcohol, which adversely affects businesses like them as they of course have to pay full duty on their alcoholic drinks ranges, and maintain a licence to sell such products. I agreed to follow up on this issue, which sees law abiding businesses and government on the same side seeking to enforce tax laws.