The Telegraph amended this and added a headline without my consent.The vast ambition of the net zero policies envisages most people switching their heating to electricity, their travel to bicycles and electric cars, and their diets to vegetarian options. It certainly needs the wholesale conversion of electricity generation from coal,oil and gas to renewables, and a solution to what to do when the sun does not shine and the wind does not blow. We need to ask are consumers ready for changes of this magnitude?So far governments have concentrated on doing what should be the easier bits of the change over. They have considerable influence and control over energy markets and have increased their interventions in them. They have ordered more renewables and pressed for closures of coal based generation. They have used subsidies, tax breaks, windfall taxes, regulations, managed prices and bans to tip electricity generation more strongly towards wind and solar power away from fossil fuel. They have got support or acquiescence from the industry to this pathway. Industry actively promotes renewable power as a good. At home it is forced to roll out smart meters to an increasingly sceptical group of consumers who have resisted them so far. It has come forward with many new windfarms and solar arrays.Even this transition in the UK has hit some buffers. More renewables means more grid to handle the great variability of output and to transfer the power from offshore and from the north to onshore and in the south where most of the customers are. The industry is behind on increasing grid capacity, and plans for it are delayed by planning processes that reveal the opposition to pylons in local landscapes. It is all more cost for consumers and taxpayers.The digital revolution sweeps on because people like its products and services. We have seen a near universal adoption of mobile phones. The majority have signed up readily to the internet, have liked downloading entertainment of their choice when they want it, have turned to social media and on line meetings to keep in touch with friends and family, have undertaken many a google search, let their photos and memos be stored on an Amazon web server and usually use Microsoft software. A handful of leading US companies have swept the globe with their new products and services without government subsidy, tax break or exhortation.So far the green revolution has not fired the same enthusiasms. Battery electric cars are still a hard sell. Heat pumps with a £7500 subsidy do not fly off the shelves. Whilst many people do say global warming is a problem and something should be done about it, few think it sufficient of a problem that they need to change their travel, heating and diet. There are determined minorities on both sides of the argument. One group say it is essential people are made to change to stop the rise in temperatures. They want tougher tax rises, more restrictions on drivers and bans on fossil fuels. One group says it is all nonsense, with a variable climate affected by many things in addition to human carbon dioxide. They do not want the government interfering and think adaptation much cheaper than prevention if temperatures do rise. The majority in the middle would like policy to be gently pointing in a less carbon direction, but not in a way which would worsen their living standards and put up their costs.The all electric battery car is mainly bought by fleet buyers who benefit from a tax break and have to show their shareholders they are taking net zero seriously. Hertz car rentals has recently announced it bought too many electric cars and is unable to rent them all out, so it is selling some of its fleet. In the UK most individual car buyers think battery cars too dear, worry about their range and how you would be able to recharge them. Some think it would be better to develop synthetic fuels which can already be produced in small quantities. These work in conventional engines and be supplied through existing filling stations.The heat pump is an even more difficult sell. If like many you have an older house you first need to spend a lot with disruptive works to properly insulate the whole building. You then face an installation and supply cost of around £15,000 before subsidy with more works. You may need to put in bigger pipes and radiators to get it hot enough. Whilst the heat pump does cut the amount of energy needed to heat the home, given the much higher cost of electricity per unit of energy the running costs can still come out higher than a gas boiler.Some think it better to keep a modern gas boiler and change the gas fuel used to fire it. Increasing volumes of hydrogen or its derivatives made from renewable electricity and water could be fed into the gas supply as the power becomes available. There is little point people buying a heat pump system all the time we depend on gas fired power stations for the extra demand. Why burn the gas in a remote power station, losing energy in transmission, when you could burn it at home?More people are turning to vegetarian diets but no political party is going to ban meat or impose a special meat tax anytime soon. When the Dutch tried to cut back animal numbers on local farms as part of a net zero strategy there was a political earthquake with a new Farmers party and the Wilders party helping evict the government that did it. The best way to wean people off methane intensive animal products is by producing better alternatives.The world cannot get to net zero without major changes of consumer behaviour. The digital revolution shows people are willing to make big changes in the way they work, enjoy entertainment and talk to each other if you produce great new products and services. The Green revolution designed by global civil servants and forced upon us by governments still has to find the iconic products that would fire the imaginations of families. People do not want a landscape covered in pylons, a car that cannot make it easily to the next working charging point and a heating system that is a lot dearer than the one they have got. They do not want to be stuck in more traffic jams as highways authorities make it ever more difficult to get about in a van or car. More do now worry about what happens to everything electric when the wind does not blow and when evening darkness has closed down the solar.

Category: Uncategorized

Two modern arguments against nationalisation

The two best arguments against nationalisation today are the Post Office and the nationalised rail companies Network Rail and HS 2.

Both of these have lost taxpayers a fortune. Both have failed to deliver good service and to achieve the aims set for them by governments.

The Post Office under Labour and Lib Dem Ministers bungled putting in an expensive new computer system. It then blamed its sub postmasters demanding money from them they did not owe and putting many into court and prison. Under Conservative Ministers since 2015 the Post Office has delayed and diluted efforts to correct the record and compensate those falsely accused.

In recent years the Post Office has racked up losses of £1400 million plunging the balance sheet into the red . The Post Office is only allowed to trade by its auditors with a Treasury guarantee to pay all the continuing losses. Without a taxpayer guarantee the PO is now bankrupt.

HS2 Ltd has presided over a massive escalation of costs to build a railway line, and allowed long delays in building the track and ordering the trains. So bad has it been it has resulted in deleting important parts of the original plan whilst we await a new track between Birmingham and London for a train which was meant to improve connections for the north. If they had stuck to the original budget and timetable we would at least have got a new railway to the north.

Network Rail has presided over colossal losses. It regularly shuts sections of railway down for maintenance at holiday periods when more people might need a train. They do not resurface the main runways at Heathrow over a bank holiday. It is often the reason for train delays and cancellations with points and signals failures, and with flooded and undermined track.

Network Rail has been slow to introduce digital signalling that would allow more trains to run safely on the same track, knowing exactly where all the other trains are. Its vast rambling property estate is poorly kept, and underdeveloped with often a negative response to ideas to develop station property better.

All 3 of these nationalised companies have paid large salaries and bonuses to senior executives regardless of the losses and poor performance. There have been many changes of Minister and 3 different governing party governments ( Lab/Coalition/Conservative) presiding over these companies. How can you argue this has been a good way to run things? Don’t private sector companies like Amazon and Microsoft do things better?

Sorting out water

There are 3 ways forward for a company like Thames Water. There can be a deal between Regulator and the current shareholders and management agreeing an affordable investment programme and realistic customer charges for the task. There could be a move to force a sale to new shareholders by undermining the current company, with a possible period of management by a government Administrator. There could be nationalisation.

Nationalisation is a particularly bad idea. Existing shareholders would need to be compensated for the enforced sale of their shares. State confiscation of the assets of the UK Universities Pension Scheme and the Ontario Municipal Pension Scheme would be contentious. To do so could put off the many investors and supporters of private finance activities that the UK relies on. University teachers in the UK might demand compensation for their pension scheme.

After deciding what to pay for the assets the state would then need to find additional money to increase the investment spend. It would all add up to a very large bill for taxpayers. In the past nationalised industries have also been good at running up large losses taxpayers have to pay. Current state enterprises, the Post Office and HS 2 have shown just how huge the losses and cost overruns can be.

Tipping a water company into Administration also comes with considerable costs as well as reputational damage to the UK as a good place to invest. The special Administration of an electricity company was costly for taxpayers.

To those who think the company should be bankrupted and the debts written off and not met, I remind you that the government and Labour rely heavily in their forward plans on harnessing large sums of private capital to provide the extra homes, energy capacity, broadband and the rest we need. If the country got a reputation for stealing assets off investors and undermining businesses by unrealistic price controls and regulations that would get a lot dearer and more difficult to pull off.

The best way forward is a negotiated settlement between the company and the Regulator. As most want faster progress with expanding capacity of our dirty water pipes there needs to be an increase in spend and in customer contribution. If we want more and better sewers then either customers or taxpayers have to pay more. As it is the same people paying VAT, Income tax and water bills I prefer it to be on water bills. There needs to be a clear link and financial discipline on water companies between revenue and renewal expenditure.

There is the added complication that Thames Water is owned by a holding company that now says it has run out of money. Uk taxpayers and water customers should not bail that company out. It is not itself a highly regulated water monopoly serving UK customers. If they need to tell the shareholders they need to get more money from them or undermine their investment further then that is a matter for them which should not affect the UK state.

The Bank of England lets its Magic Money tree wilt

Great news. The Bank of England has reviewed its money policy over lockdown and the period 2020 to 2022. It has concluded it worked well against a very difficult background. It thinks it can repeat its successful Quantitative easing operations in the future. Meanwhile it’s best to sell lots of bonds and lose lots of money. They think

1.The big inflation had nothing to do with the creation of £450 bn to buy bonds at very high prices and the suppression of interest rates. It was the Ukraine war that gave us inflation. It is irrelevant that Japan, Switzerland and China who all import a lot of energy did not have the same high inflation.

They think

2 It is crucial that the Monetary Policy Committee does not consider the quantity of money. It is right to ignore it and not to monitor it or report on it.

They think

3. The big sell off in government bonds under Liz Truss had nothing to do with the Bank’s decision to sell £80 bn of bonds or with the decision to increase interest rates .

They think

4.The current recession is necessary to complete the task of bringing inflation down. Later this year it will be necessary to lower rates to provide stimulus to get some growth back, but there is no need to hurry.

So there we have it. A Bank whose main task is to keep inflation to 2% is blameless when it goes to 11%. A money policy committee is right to ignore money and believe they can print as much as they like without causing inflation. A Bank can sell lots of bonds at huge losses and send the bill to the taxpayer but that has no bearing on recession or government finances. April 1 is a great day to remind people of these findings.

Thames Water. Paying for bigger sewers

The nationalised water industry had a bad record, putting sewage into rivers and the sea. It spent too little on expanding pipe capacity and on replacing old and damaged pipes, as the costs fell on taxpayers. Water lost out in many a public spending battle under Labour, Conservative and Coalition governments pre 1989. The UK had sewage strewn beaches in the last century as well as dirty rivers.

Privatisation freed the industry to raise new capital, shares and debt. The Regulator limited the amount the companies could spend on new investment and imposed price controls on what they could charge.Progress remained fairly slow in renewing and expanding the system, though more was spent than under nationalisation. Substantial sums were freed through the sale of new shares and extra long term loans. The rapid escalation in inward migration under Labour from 1997, and the further large increase this Parliament added to the need for more capacity.

Thames Water is 51% owned by the Ontario Municipal Pension Fund and the UK Universities Pension Fund. Other minority shareholders make up the mix.

The Company has undertaken substantial investment in recent years, stepping it up to £1.77bn in 2022-23 alone. It has not paid any share dividends to its external shareholder owners since 2017, ploughing back as much money into investment as possible. It has also taken out large borrowings to finance new pipes. Debt now adds up to £14 bn.

Thames provided a breakdown of how it spends each pound of receipts in 2022. 46 p is spent on new infrastructure. 19 p is spent on operational costs and 15 p on employees.7 p is spent on energy, 5 p is paid in tax and 8 p is paid to lenders as interest on the debts.

Labour has said it does not recommend nationalising it. The government have no plans to nationalise it. It would be difficult to increase investment spend as people want were it nationalised given the extra strain that would impose on state budgets.Whether nationalised or privatised the decision is the same. Should Thames be allowed to put up its prices more to speed up and increase its investment or not? I will look at the available options for Thames in a future blog.

Nationalisation is a bad idea

There are several strong arguments against the nationalised model for providing commercial services like phones,water,electricity and gas as we used to suffer.

1. These services never had sufficient priority in public spending to access sufficient capital to modernise and expand.

2. As monopolies not facing daily competitive pressure they put up prices too much and tolerated poor service.

3. As monopolies they often made bad decisions about investment that then cursed the whole service. BT for example when under state control spent a lot on rolling out outmoded electro mechanical switching when the US was well advanced with superior electronic. The UK’s supply industry was unable to sell the Uk spec products for export as they were out of date. The electricity industry stuck with new coal power stations , only opting for cleaner cheaper more fuel efficient gas after privatisation.

4. These businesses were overmanned with low productivity. This led to getting rid of staff and charging too much.

5. The losses on nationalised industries exposed to international competition like steel and coal were huge. The railways also ran up huge losses.Taxpayers had to pick up the bills.

When making the case against nationalisation I was able to demonstrate nationalised industries were bad for customers, charging too much, bad for taxpayers, costing too much, and bad for employees, getting rid of so many.

Devolution and growth

There is no evidence that devolving power to regional governments in the Uk foster more economic growth.Indeed there is evidence the opposite is true. SNO Scotland and Labour Wales have grown less than England. The NHS in Scotland and Wales both cost more per head but perform less well than NHS England.

There is no reason why an additional layer of government with more officials would make somewhere more prosperous. Regional governments want to impose more and different regulations than the national government. Both the Welsh and Scottish governments wanted longer and tougher lockdowns for covid to add to the damage lockdown policies did.

The regional governments become campaign platforms for their First Ministers and ruling parties who use their position to criticise and undermine national policies. They lobby for more money and get more spend per head than England. They then prove more public spending does not lead to faster growth or better economic performance.

Many Councils in England use their positions similarly. Politicians like Kahn use their platforms to try to undermine the national government. They pursue their own vendettas against van and car drivers, damaging local businesses and shopping centres. They claim be short of money yet they spend a fortune on wrecking the roads. Many buy up portfolios of commercial property and renewable power generation , risking taxpayers money. Some lurch to bankruptcy as a result.

The Opposition parties who want more of all this will level down any more successful place they win, whilst failing to tackle poverty, lack of successful business and run down urban centres elsewhere.

The NHS

I usually agree with the electorate whose opinions reflected in issue polls are often more sensible than the views of government and opposition parties.

I agree with current polls that reveal a deep dissatisfaction with the NHS. I do not agree that the answer is more money. If only it were that simple. If more money on its own would fix it we would have fixed it this decade.

Spending on health has shot up from 2019. At £180 bn this year, it is £56 bn or 45% higher than in 2019. It is true prices and wages have gone up. Adjusting for this the NHS is receiving more than 20% extra. That is a much bigger rise than the Brexit savings on the side of the bus. They and tax rises have all been absorbed into the NHS budget.

The NHS will each year need some extra money.We want nurses and doctors to be well paid and the NHS to be able to afford new medicines as they become available. It would help reduce the strains on the service if there was a large reduction in legal migration, as recent years have brought in plenty more patients.

It is also true that in recent years there has been a big increase in non medical staff numbers and an expansion of senior grades of management. There has been a big drop in output per person implying the extra management has made the lives of those doing the medical work more difficult and bureaucratic.

More money should only be committed to achieve better outcomes for patients. We need better management, probably with fewer managers.

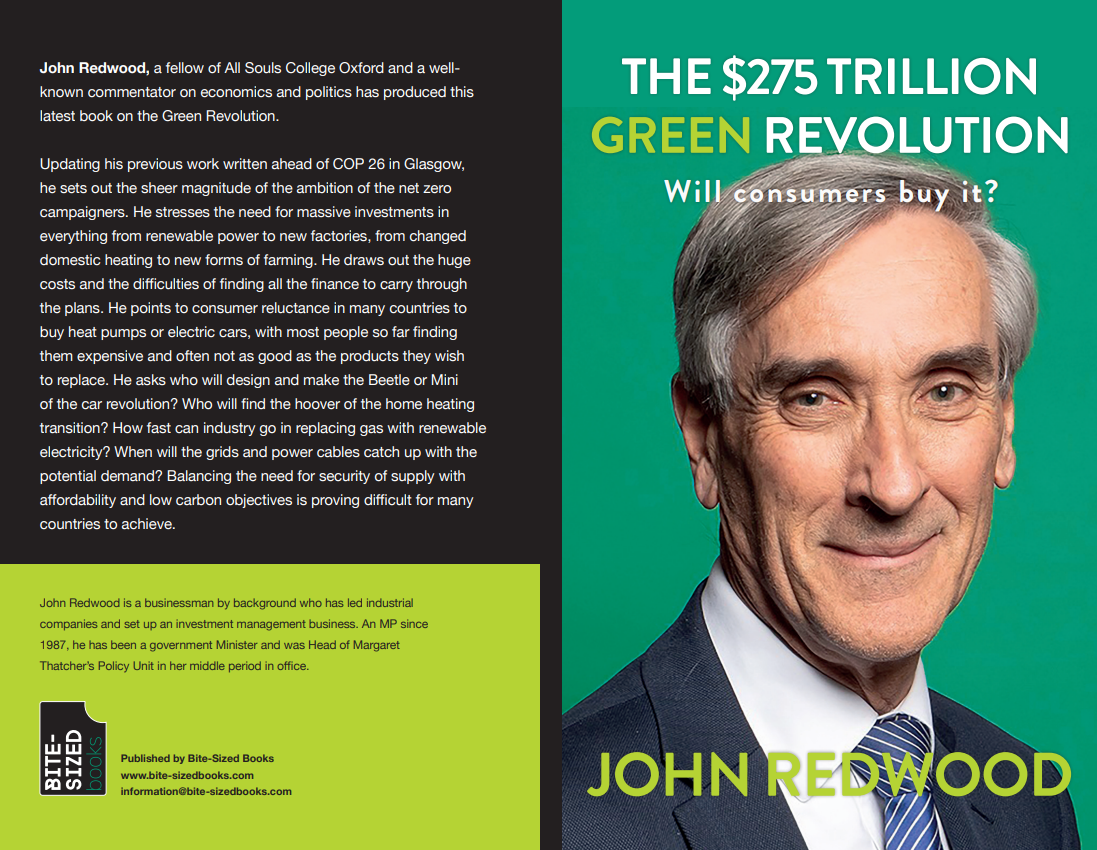

The road to net zero. The $275 trillion bet

I am bringing out a short book updating my work on green policy. Titled “The $275 trillion Green Revolution. Will consumers buy it? “it is published by Bite sized books and available on Amazon here: https://www.amazon.co.uk/275-Trillion-Green-Revolution-Consumers/dp/1738558428/ref=sr_1_1?crid=3RC5ABLGBLE5Q&dib=eyJ2IjoiMSJ9.MhlzOxY1chcW2WlWoSkhZD5sZpuILHQfDW061MBLpTkaRxrfT2uc_njXk5hxfh8ai4JjHGzAJ_uz66TOSHcJOlUqxMql0zDVfrQpZfOW0RIr3pMYf54GpLnqgwli7y4Jm3Mm4WCOZCk14IANoeqqc3FAixqnCvz5swKzl6H_gBHsCnNzUUGWlJT_Uwaolg2d2iJCjeaLteCcfFtmZjaZsK0dbb3BCHZjEmrrnOE8vXg.JtAVgfOd9pzJKfUEX_Av8HjAV4WOiBbKUkHX4O8kkEc&dib_tag=se&keywords=John+redwood&qid=1712055538&sprefix=john+redwood%2Caps%2C121&sr=8-1

It looks at two main problems with this top down movement led by an international Treaty based elite and by most national governments. It asks how will this all be paid for. It sets out how consumers currently do not buy into the products the governments want them to adopt, from battery cars to heat pumps and from smart meters to non meat diets. It takes the Mc Kinsey global forecast of expenditure needed for transition in the period 2021 to 2050.

Government energy policy

This site normally sets out government policy and provides proposals to change or improve it. I run just two articles explaining aspects of Labour policy and some of you complain. Yet at the same time some write in to tell me they will not vote Conservative even if that means a Labour government .They should at least be willing to think about and discuss Labour policy as current polls say Labour can win the election. It is also worth thinking about how the official opposition would like the government to change things as they can try to get rebel Conservatives to help them.

There is now a substantial and I urge growing gap between Labour and Conservative over the road to net zero. Conservatives now recognise the need for more gas generated electricity for the time being to keep the lights on. Labour wants to close all those stations by 2030 and depend on renewables. How would they keep the lights on when the wind does not blow and the sun does not shine? Conservatives want to get more of our own oil and gas out of the North Sea. Labour want to ban all new oil and gas development at home and import instead. More home energy means more well paid jobs and more tax revenue at home.

The government has said it sees it needs to be realistic about net zero. That means letting people buy petrol cars and gas boilers for longer. It means waiting until much more nuclear power is available, still a decade away at best.It means taking synthetic fuels and hydrogen more seriously as possible runners. Believing you can get to net zero on power generation by 2030 and rely on more windfarms cannot work.

The government need to amend their lecturing taxing and subsidising in favour of various car and heating systems that are not as green or as good as some Ministers seem to think.