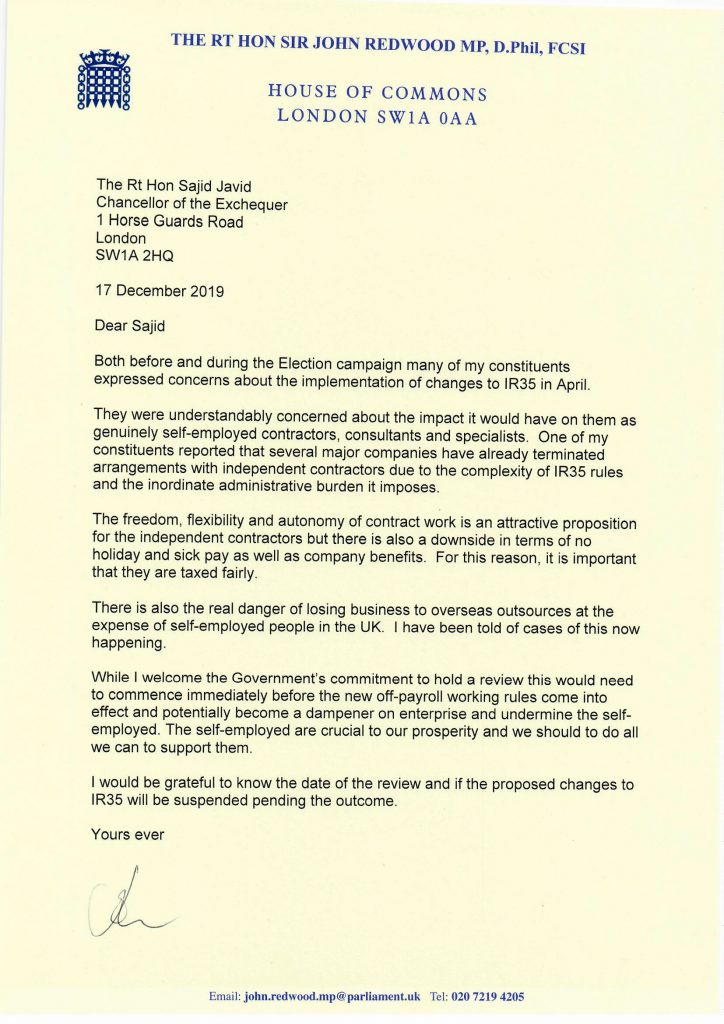

I have today sent this letter to the Chancellor about the proposed changes to IR35 – a matter of great concern to many of my constituents. I have urged him to start the review immediately before the changes come into effect and potentially become a dampener on enterprise and undermine the self-employed.

December 17, 2019

Will you also ask Javid to either give everyone the same pension perks as judges, as its discriminatory. If not will he do what the Tories have done to lots of people, retrospectively tax them.

December 17, 2019

https://www.gov.uk/guidance/check-employment-status-for-tax

Seems relatively straight forward to me.

If you do most of your work for one employer at their direction you are effectively employed which bestows on the worker or employee the rights you express concern about in your letter Sir John.

I am all in favour of us all being able to pay less tax but we do need a level field.

December 18, 2019

There are genuine cases of the new rules stopping those that have been circumventing the rules for some time, which is right and in fact, they have been operating on the wrong side of IR35 since 2000.

However, the issue has been the knee jerk reaction of the purchasers of the consulting services whereby they have taken a blanket response and classed all freelance consultants as inside IR35 (including the refusal to use consultancies that hire freelance) and put in policies to halt the use of genuine freelancers: Vodafone, HSBC, Lloyds Bank to name only a few.

In fact, in my area of expertise, Financial Services, all institutions that I know have taken this response and I am sure other industries will be the same instead opting for large international consulting firms or moving roles away from the UK.

The review needs to take into account the full impact on the genuine UK based freelance consulting firms hiring circa 1 to 10 FTE that are being pushed into oblivion. – I run a small firm that takes on Fixed Contracts and scales with independent contractors I can not support a permanent bench the same way a big 4 consultancy can but now my clients refuse to give us contracts due to the aforementioned internal policies.

December 19, 2019

Pay less tax? Last year as a contractor I paid £85k in tax. This year I have now taken a similar perm position and will pay half of that.

December 20, 2019

None of the calculations by the HMRC account for VAT correctly. Financial services and most likely a lot of public bodies such as the NHS are VAT exempt.

Consequently the freelance contractor is a VAT collector for the HMRC in those industries and the ultimately purchaser of services cannot claim the VAT back as input tax.

None of this is shown on the HMRC calculations which is peculiar since they should know their own tax system, so presuming that they do why mislead elected politicians?

December 20, 2019

Bev … you have demonstrated the fatal flaw in the approach being undertaken by HMRC (etc) … in pursuing this percieved under payment of personal tax liabilities by contractors they are risking a transition of these same resources into the permanent employment space. The result of which to an individual contractor is a few thousand in increased personal tax liabilities at a loss of tens of thousands of company related tax liabilities. Barking mad in my opinion.

December 18, 2019

The trouble is that the CEST tool does not actually reflect the law and court rulings. It can’t because the law is poorly drafted and open to interpretation.

Also, being employed for tax purposes, does not (as the law stands) necessarily mean you also receive empowerment rights.

December 18, 2019

Well therein lies the problem Narrow Shoulders. Define “most”? Define “employer”? Also – the end users are telling the PSC contractors that they can work via an Umbrella company or leave thus the end user avoiding paying the Employers National Insurance and Apprenticeship Levy – as that get’s dumped on the contractor or he is effectively out of work.

December 18, 2019

…And this is the issue which continues to be falsely promulgated – being employed for tax purposes does NOT bestow on the worker any rights such as holiday or sick pay, life insurance, or pensions – these are precisely the things that any self-employed person has to make provision for.

Whilst direction and control are a big component, one must remember that the majority of self-employed engagements are because the individual or company concerned does not have the skills or expertise to carry out the work – very similar to hiring someone to replace your house roof, if you are not a tiler. We therefore work under our own direction and control (would you tell your tiler how to put the tiles on your roof??)

I am all in favour of us all being able to pay less tax, but I have no wish to pay more tax AND have to provide my own employment benefits as well!

December 18, 2019

I don’t think you understand at all.

April moves the tax risk from the contractor to the client. At any point in the future HMRC can decide to challenge the decision (inside/outside) and demand back-tax over a considerable period – from the client.

The main purpose of hiring temporary staff is to streamline your relationship with them and lower your risk, not to be possibly liable for tax years later.

Would you hire a plumber if you then became liable for his tax affairs?

December 20, 2019

And if they challenge the condition and the fee payer agrees then all taxes paid by the contractor needs to be refunded by the HMRC because the contractor was paid net of tax. This means corporation taxes, NI and PAYE will have to refunded.

Can we seriously even contemplate such a half thought through legislation? Does it remind anyone of anything similar? FTPA?

Both FTPA and offpayrolls were instigated by LD.

Why are Tories abolishing one but pursuing the other?

December 18, 2019

You are going to need broad shoulders with a comment that shows such a basic lack of understanding. I mean you link to CEST which is the most ridiculous tool out there to ‘assist’ with determinations!

December 18, 2019

It’s not at all straight forward, that tool is far to biased to trying to fail the person and a very heavy percentage get indeterminate outcomes. Questions like do you use you own equipment are clearly biased to construction workers, I work in IT specifically financial services and for data protection reasons we are not allowed to use our own laptops etc. Then there’s the right of substitution and if the hirer have the right to veto the substitute, clearly that’s a nonsense question as no one is going to take on a specialised contractor and then say ‘but feel free to substitute who you like’. There’s also questions around when and where you work which again if you’re fulfilling a specialist role in a project team who clearly need to work with others so saying you can work when and where you like isn’t going to get you much work.

Plus which the playing field is pretty level already actually biased to the full time employee.

December 18, 2019

Not really

HMRC is suggesting that employment agencies take PAYE tax at source before paying, but the contractor would still not be eligible for pension contributions, holidays, sickness etc.

For many people it would become a strange halfway house taxation system with both employers and employees penalised and the economy suffering as temp roles cannot be filled.

December 18, 2019

It’s not as easy as that I’m afraid, Narrow Shoulders. HMRC’s CEST tool has been proved in court to be deeply flawed and their guidance to be so woolly and nebulous it’s unworkable.

December 18, 2019

Narrow Sholders: It’s not straight forward, I’m a contractor offering services to end clients which are also externally facing i.e. I speak externally on behalf of the end client and due to the type of work and workload, it’s is impossible for me to work across multiple clients at the same time. Considering you used the CEST tool I think you need to take a harder look at how IR35 is assessed and the practicality in real world scenarios.

December 18, 2019

Its not the rules its the implementation. The decision is going to be made by the end client now. Which on its own doesn’t sound too bad, except those companis are deciding all cases are inside regardless of the actual working practices relevant to the rules. They are doing this simply to avoid the risks of getting a few wrong.

As nobody in there right mind would work for without pension, sick pay, holiday pay and have the constant risk of the contract being cancelled the next day with no recourse amoung others for a standard PAYEE salary and tax this could destory the flexible IT work force.

These same companies will still want a flexible workforce, so the will simply go to India for it.

December 18, 2019

Unfortunately it is not quite that simple. The link you posted is for the CEST tool which has been widely criticised by employers, contractors and the courts. It fails to take into account the single most important aspect that determines if you are an employee or contractor and that is Mutuality of Obligation. HMRC also like to ask courts to dismiss this tool as evidence if it says that a contractor is not an employee… They do however want it included as evidence if it seems an contractor is an employee…

Basically if you are required to be given work to do then you are an employee if however the company can simply tell you to go away for the day unpaid then you are a contractor.

The other issue with IR35 is that if you do happen to fall under its rules then you are required to pay tax like an employee. However it does not give you the right to claim working rights as an employee so you pay the tax but do not get the holiday pay, sick pay, redundancy pay, pension contributions etc that the employees get. Surely that can not be fair?

IR35 is a mess and needs a total review. The government have already been caught peddling the HMRC fake news line of “90% of contractors should be in IR35” when in fact HMRC have lost 80% of cases in court! Given that they surely only take the cases they think are a high win chance to court then it suggests the vast majority of contractors are legally outside of IR35? This does not bode well for any review unless the Government admits that they have been lying all this time…

December 18, 2019

If it were that simple then why do HMRC get it wrong so often? Employment status is based on case law, not HMRC’s biased interpretation of case law. As contractors we are specialists in our field….we are not contract and employment law specialists in addition to our chosen speciality. By the same token, HR staff within client companies are not either, but they are now expected to assess thousands of contractors, their contracts and working practices. If they get it wrong and state a contractor is outside ir35 then HMRC will hit the client for the lost employers ni. Hardly surprising then that client companies are refusing to engage Ltd company contractors. Why would any company take on that level of risk? Instead its umbrella only. That’s the contractor paying paye, ni and employers ni abd still retaining the risks inherent in contracting.

December 18, 2019

Great, level the field!

When Gordon Brown introduced IR35 twenty years ago, he made the rules as vague as possible in the hope of trapping as many as possible.

The rules are written to consider employment status “for tax purposes only”. No IR35 outcome provides any employment rights, just robs a contractor of the ability to make their own provision for holiday, pension, sick pay, gaps in employment.

December 18, 2019

I am afraid the CEST tool is not straight forward at all. Please google “ir35 blanket approach” – companies are getting rid of contractors en masse regardless of the true IR35 determination as they don’t bother using it.

Instead, lost jobs are being outsourced to no benefit to the UK taxpayer!

For example, if a contractor ceases to provide services via limited company and become a full-time employee HMRC will lose approx. 40% of the total tax (VAT, Corp Tax, Dividends Tax) contractors pay in exchange for a slight increase in NI. Not to mention the services contractors will no longer use services such as accountancy, insurance, agencies.

It seems that ideologically based civil servants in their ivory towers don’t understand to what extent IR35 rules are damaging.

December 18, 2019

You should really educate yourself on how these engagements actually work, as your ignorance on the subject is clearly causing yourself some confusion.

The net result for most contractors who opt to go into a PAYE arrangement with thier existing client will result in a pay cut off over 25% whilst not garnering any of the usual employee benefits.

This will be at best a modest increase in the amount of national insurance contributions collected, and a massive loss in corporation tax as a result.

Over all its a big net negative

December 18, 2019

The difference is you get none of the security, employment rights, pension payments or benefits of an employee. It also doesn’t take into account that most contractors work extra hours on business admin etc., have to pay accountants and PLI and provide and maintain their own vehicles/kit/tools/clothing/ppe. How is that a level playing field?

December 18, 2019

Except they aren’t directed. That’s the point. You don’t employ a plumber to fix your tap and then tell them how to do it. You let the specialist get on with the job they’ve been employed to do.

December 18, 2019

That statement is factually incorrect, an employee person gains company benefits such as medical, paid time off, paid public holidays, workplace pensions, sick pay and access to benefits when not working. Self employed contractors have to finance their own pension, their own coverage for sickness. They have no paid time off. To tax them as a permanent employee is grossly unfair.

If however IR35 bestows those rights into contractors and consultants that great. I will happily pay PAYE.

December 19, 2019

Narrow Shoulders,

You really are missing the fundamental flaws in this proposal rather badly.

What level playing field are you referring to exactly?

December 18, 2019

In reply to the second commentator.

No, under the IR35 rules if you are deemed to be caught by them you do not qualify for employee rights, you just get taxed like one. In fact you actually get taxed more as you are also liable for the Employers NI in addition to Employees NI and Income tax. This means you are effectively taxed an additional 13.8% over and above what an employee would pay. Add to this that many freelancers working through umbrella companies where IR35 applies also end up having to pay towards their “employers” Apprentice Levy, something genuine employees do not have to cover.

December 18, 2019

@narrow shoulders – your bitterness misses the point. If the freelancer is to be paid and taxed as an employee – then the freelancer should receive the same benefits as an employee. That’s a level playing field.

December 18, 2019

Narrow Shoulders:

Tax treatment between the employed and self-employed is already largely equalised. This is a new cost for employers which is disrupting the contract market.

– The CEST tool you link to remains unfit for purpose, as it does not take into account Mutuality of Obligation, which is a decisive factor in many Tribunal cases

– If you fall within IR35 under the new rules, you do not gain any new rights – that is employment law. You IR35 is about tax law. You would remain without employment rights, but the hiring company must pay Employers’ NI on the contract.

– However, there is evidence that hiring companies are trying to reduce rates to equalise their before an after cost. So the Treasury gets a slice, but it is the contractor who is worse off.

Not so straightforward is it?

December 18, 2019

Even where contractors have gone through the CEST tool and come up with an outside IR35 status the end clients are still stating that they will be taking the blanket inside IR35 position for all their contractors. This is not a single organisation or indeed private sector, it is multiple global organisations across multiple sectors. As a result thus far I have 15% within my network now looking abroad.

I’m yet to hear the argument of why it is a good idea to go down this blanket ruling path other my guesses of risk aversion and perhaps the cost of additional workload.

If the government want to have a competitive economy entering into Brexit, then they should consider the value the flexible workforce offers before they decimate the market.

December 18, 2019

Good to see someone press this with the Chancellor. As someone who would have voted Conservative if I had thought that his promise was not just “lip service” to garner more votes, I’ll be glad to be proved wrong if a proper review is undertaken.

However, I hope it doesn’t go the way of the 2010 review, when the Conservatives promised an abolition of IR35, but then strengthened its hold on the self-employed market.

December 18, 2019

Thank you John for being one of the few to get the gravity of this. It’s a major issue loads of people already out of work, jobs already going abroad. Rather than making the treasury money this IS going to lose then millions or even billions and the people that created this mess are burying their heads in the sand.

December 18, 2019

Mr Redwood, many thanks for your support on this matter. It’s a genuine and real concern for very many contractors/consultants such as myself and I look forward to a positive response from your colleague Mr Javid. Your observations are correct, in the post Brexit world that I’m personally looking forward to, the self-employed sector will require encouragement to grow, not have obstacles put in its way. The UK is a nation where personal endeavour and entrepreneurialism has been encouraged – the Tories champion this idea more than any other political party, therefore I look forward to seeing the Conservative Party continue this tradition beyond April 2020.

December 18, 2019

Dear Sir John,

Its great to see you as MP of my constituency Wokingham raising voice for self employed professionals, I am one of those affected. I sincerely hope that people like you listen in the government and hold off the changes untill proper review has taken place.

Thanks

December 18, 2019

Great news.

The contractor market is one of the golden geese that provides for a successful UK IT industry.

The contractor industry is a fundamental part of the knowledge and skills circulatory system of UK IT (and is essential given how quickly things move on).

The IT industry is in turn foundational to the financial services industry.

If these IR35 changes kick in, it will permanently damage the industry, this won’t be seen in job losses but in decreased productivity and higher costs.

December 18, 2019

Sorry Narrow, but no it doesnt. I have no security of contract (A weeks notice even after many years), no ho;liday pay, no sick pay, I pay national insurance twice (Employers & Employees)and income tax twice. If I am treated badly by the so called employer I cannot bring a claim in the industrial tribunal (Because I’m not employed), I get no redundancy, no death in service. So I am only employed for tax reasons not for employment protection. HMRC cant have it both ways. Either we are employed and only pay one lot of tax and NI and have rights, or we are self employed and take the risk. Either is fine by me but not what is in place now.

December 18, 2019

I and many of my fellow Contractors welcome your support John. The need for temporary resource is still very important to many UK businesses, small, medium & large. As the country moves toward Brexit then a strong flexible workforce will help the UK survive and prosper. However at this time many freelancers are holding profit back and not investing, purchasing equipment or undertaking training for fear of what is to come. This also holds true for many freelancers pension contributions. Thank you.

December 18, 2019

Yes I do agree we need a level field. But this level field is applied only in terms of applying tax rules.

1. In the case of perm employment, Employer NI is paid by the company. That’s not the case with contractors or temp workers. It is deducted from their income.

2. Companies contribute to employees pension and avail benefits for that generosity. It’s not the same for the contractors.

3. This punitive measures applied only on individual contractors but not on overseas outsourcing companies. Are their employees working on different stuff to the perm employees.

The list goes on….

December 18, 2019

Thank you for sending this letter to the chancellor, it is very much appreciated and certainly needed.

My clients are telling me the administrative burdens being imposed on them are both complex and weighty.

Companies are going to be put in the difficult position of becoming less able to flexibly engage the workers they need for short term projects when this goes ahead.

And topping this all off is the fact that the exchequer will likely be worse off as a result of the loss of vat revenue and potential lowering of rates.

It just seems like everyone looses with the current plans.

As an objectivist I find the level of state intervention very sad.

Once again, thank you for your intervention.

December 18, 2019

What if there is not a permanent position available at the company you contract to? Many of us simply cannot continue in our careers & will be unemployed.It is just not viable to drive hundreds of miles, pay for accomadation etc. We just won’t be able to do it.Many companies will fold because of this.

December 18, 2019

The word “level field” sums it up that you have very little understanding of the subject. Not everything has to be “level field”. There has to be link between risk and reward, otherwise there is zero incentive to take risk being flexible workforce.

December 18, 2019

Thank you for giving this your attention and raising the matter with the Chancellor.

December 18, 2019

Today 200 IT contractors were terminated including myself at the corporate I have been working for. The work is being transferred to India. So no tax gain!

December 18, 2019

The company I work for is a FTSE 250 distributor with a UK base, they have one deal signed (with five teams stood up) and another one in the pipeline to send UK jobs to two eastern block countries as an alternative flexible workforce arrangement. Short-sighted political rulings… The so called “level” playing field has to be levelled globally for levelling to work, we live in a global society

December 18, 2019

People don’t make any sense when talking about a level playing field. The letter makes perfect sense… You have a choice in terms of your preferred working arrangements… You choose a benefits package, job security, notice period, supplemented pension etc …or… Flexibility, no benefits package or sick pay or holiday pay etc

Of course it makes sense to be taxed differently and fairly. Why should the same tax rules apply for both working models?

December 19, 2019

The trouble is many private sector companies and government agencies are using a blanket approach because of the risk of investigation and liability of taxes due to the IR35 reforms. This is most unfair, I have multiple contacts now, but if all my clients go this route, then I will go bust, I can’t afford to operate a Ltd company business and pay costs after PAYE tax, it’s nonsensical.

December 19, 2019

Hi John,

Thanks for raising this. It is affecting alot of clients of mine who are losing their ability to work and be entrepreneurial.

It has been devastating in the public sector aswell.

I hope this can be postponed, the current position is working fine and should be protected.

Kind regards

Zee

December 19, 2019

The flexibility contractors give employers is vital. Some companies have let contractors go en masse as they don’t know how re-write contracts to change their status to consultancies.

Contractors can be let go of more or less at any time thus they have to be prepared to travel further and accept the fact the employment can be terminated at short notice for this they get paid more money. Also some contracts by their very nature are Short term and only last as long as part of a project. I would think any Tory government would encourage a person to strike out on their own form their own company and pay as little tax as possible.

December 19, 2019

In Norway the dividend tax is the same as income tax, so no delta from the states perspective. It is also legislated that as a company and company employee you must have a pension. In the U.K. many less honest business owners are shutting down their enterprise every few years and claiming ‘entrepreneurial relief’, this is what the government should seek to outlaw through legislation.

December 19, 2019

John, I am not a constituent of yours, but I wanted to thank-you for trying to get some clarity on this. If these changes do impact the economy it really is at a bad time. I will always be able to work but in the last few years I have worked in Stoke, Maidstone, Derby, London, Oxford and Cardiff as my skills are in short supply – the uk would loose this if I were to stay in a permanent role. I wonder if any analysis has actually been done on this geographical flexibility. Dean

December 19, 2019

lose. obviously my spelling is not the highly demanded skill I mention above 🙂

December 20, 2019

John,

I’m not a constituent of yours, and thankyou for raising this.

I am a contractor in a specialist technology area within Banking , my contracts typically last up to 18 months, which is the typical duration of the project.

My clients are in the City of London, the teams i engage with are world wide, but my home is over 200 miles away, so its not commutable.

The blanket response to effectively ban PSCs, has literally destroyed my business overnight, and will also now mean a signifcant loss of tax revenue in future years, it hampers a flexible workforce, and reduces social mobility.

December 20, 2019

In many ways, it is too late already. Many of the large contractor-hiring businesses have already started to change their practices in anticipation of this legislation landing. Contractor UK have a list of companies and what they are planning to do or have already done here – https://www.contractoruk.com/private_sector_ir35_reform.

If you look at the list that is linked to at the top of the page you will see the likes of JP Morgan, Santander, National Grid and more who are simply not going to engage contractors at all or who are just automatically classing them all as inside IR35.

Not surprised to read in the comments above that many firms are simply outsourcing to avoid the hassle of the new legislation, painful for the economy and the exact opposite of the government’s (more HMRC, but let’s not go there for now) intention of increasing tax take.

IR35 has cost the UK so much more than it has gained in terms of tax since it was implemented. Time for a strong Tory government to get this terrible Labour-implemented sack of silliness consigned to the bin.

December 20, 2019

John thank you very much for understanding the issue and understanding the urgency of the situation. Please keep pressing the treasury on this issue, the big 4 stand to benefit enormously from this change which is why I’m highly suspicious about HMRCs motivation.

December 20, 2019

For those who says it is a fair Schemes to tax everyone equally.

Umbrella Income £46,800.00

Employers Pension Deduction (£0.00)

Employers NI and Apprenticeship Levy (£4,686.83)

Expenses (£0.00)

Umbrella Margin (£1,008.00)

Gross Pay £41,105.18

I have already lost £5695 before I pay a penny to HMRC for employee Tax and NI. It is a win win situation for end Client and HMRC.

Gross Pay £41,105.18

Employees NI (£3,896.78)

PAYE Tax (£5,719.20)

Employees Pension Deduction (£0.00)

Take home pay £31,489.20

A contractor take home pay without any holidays, pension and company benefits is subject to 33.33% tax. For a non umbrella employee, it is 24.4%, take home pay would be £35,361.64 with 28 holidays, pension and other benefits such as Sick Pay.

How is it fair?

The government need to void the Employer NI and Apprenticeship Levy to make it fair for contractors. 0.5% of Gross pay for Apprenticeship Levy is unfair for contractor who will never benefits from it.

December 21, 2019

Boris promised no tax rises for anyone earning under £80.000 please remind him of that !

December 22, 2019

I can’t think of any permanent employees who are expected to make their pension contributions from income which has already been taxed.

Whereas they do enjoy the benefit of additional contributions from their employer.

How is this fair?

December 24, 2019

I currently contract for Santander and I have been told that they will not be extending my contract when it ends in the end of February. Instead from January, they will onshore two people from India, which we will train to take over from us, and then they will move back offshore.