Please see below my lecture at All Souls College, Oxford, titled ‘The Long Road to Net Zero’:

Slide 1

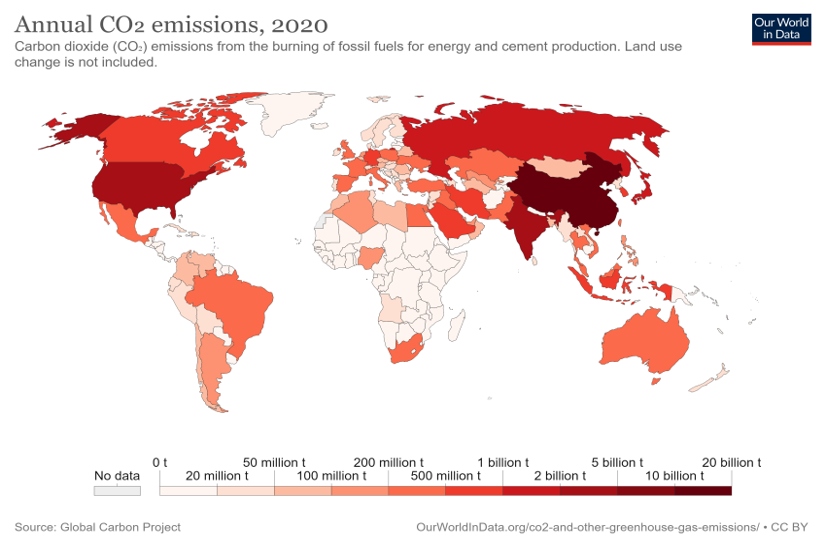

Solutions to CO 2 output have to be multilateral not unilateral. With the exception of China, no country is big enough to make a difference to world output by its own actions without buy in from others.

Reducing CO 2 substantially will only be possible if people want the new green products and services. It cannot be delivered by bans, subsidies and taxes.

Current net zero policies rely heavily on making the use of fossil fuels dearer running the danger of increasing inequalities and allowing the rich to buy themselves pardons for continuing use of fossil fuels.

Slide 2

From UN Report October 2021:

Total estimated Green House Gas emissions 2025 54.7 Gt 58% above 1990 level

2030 54.9Gt 58.7% above 1990 level 15.9% above 2010

UN says GHG emissions need to be 43% lower than 2010 by 2030 to hit 1.5 degree C increase, or 25% lower to hit 2 degrees.

This decade will see a further increase in the amount of CO2 generated by the world economy with an increase in the annual use of fossil fuels.

The main producers will be China, India and other emerging economies. The USA and the EU accounting for a quarter of current CO 2 will reduce their output a bit.

Slide 3- The Scale of the Problem

Slide 4 – The main sources of CO2

China 30.65% 10,670,000m tonnes

USA 13.5% 4,700,000m tonnes

EU 9% 2,600,000m tonnes

Germany 2% 644m tonnes

Russia 4.5% 1,580,000m tonnes

UK 1% 329m tonnes

Slide 5

Sources of energy for China

Coal – 57%

Oil – 20%

Gas – 8%

Main fossil fuels total – 85%

Sources of energy for USA

Oil – 37%

Gas – 32%

Coal – 11%

Main fossil fuels total – 80%

Sources of energy for EU

Oil – 37%

Gas – 25%

Coal – 11%

Main fossil fuels total – 73%

Slide 6 – Gas – a transition fuel?

Natural gas versus coal

EU designation

Mixing hydrogen with natural gas

Blue and green hydrogen

Slide 7 – How do you power homes and factories when the wind does not blow or blows too hard?

The dangers of over reliance on wind energy – the UK has days when wind only supplies 2% electricity

Need for electricity storage

Pump storage systems

Green hydrogen as an energy store

Battery storage

Time shifting of power use

Slide 8 – Carbon accounting

Is it sensible to shift from a petrol to an electric car?

Total carbon generated by manufacture of new vehicle and destruction of old vehicle.

Over what time period do you amortise that excess carbon

What mileage would you need to do each year to make the vehicle switch worthwhile?

How do you guarantee that your battery is only recharged with renewable power?

Slide 9

Carbon accounting

Putting in a heat pump

CO2 produced in manufacture of equipment and installation

Nature of the electricity to fuel the heat pump system

Need for heating and immersion heating back up to secure sufficient temperature to water and air ?

Slide 10

Carbon accounting for wind energy

The carbon dioxide produced during fabrication and installation of the turbines and towers

The carbon dioxide generated for replacement turbines and parts

The carbon dioxide generated for the stand by power capacity needed

The carbon dioxide produced when stand by generation is used during low or high wind periods

Slide 11 – What would make the green products fly off the shelves?

Cars – range, refuelling and recharging, cost, style

Heating systems – Average temperatures, cost, degree of intrusion

Diets – taste and appearance of alternatives to meat/ social acceptability

Slide 12

Technologies for the 2030s and 2040s

Green hydrogen for storage of renewable power

Green hydrogen to drive internal combustion engines

Nuclear power and small nuclear reactors

Nuclear fusion?

Large battery storage

More use of water power and pump storage

Hydrogen for home heating and industrial processes